The Mediterranean Region, encompassing the major economies of Spain, France, Italy, and the growing markets of Greece, Portugal, Malta, and Cyprus, is undergoing a rapid and structurally significant electric vehicle (EV) transformation. Driven by stringent EU decarbonization mandates, a powerful tourism economy, and rising consumer awareness, the region presents a lucrative but complex landscape for charging infrastructure development. This analysis reveals that the Mediterranean market is bifurcating: a mature, high-power charging race along major Western European corridors, and an emerging, value-driven opportunity in Southern and island nations. The critical insight is that a one-size-fits-all strategy will fail. Success hinges on deploying solutions that are climatically resilient, tourism-aware, and economically calibrated to the distinct maturity level of each sub-market. Companies that can offer a portfolio of reliable, smart, and context-appropriate charging assets will capture the greatest long-term value.

The Mediterranean EV market is a tale of two speeds, yet both are moving decisively forward, unified by the overarching framework of the European Green Deal.

These three markets represent the engine of regional EV adoption. •France, with its strong domestic automotive industry (notably Renault and Stellantis) and consistent government support via the bonus écologique, has achieved robust EV penetration. The market is characterized by a high share of compact EVs and early moves toward electric commercial vans. •Italy has historically lagged but is now accelerating rapidly. A key characteristic is a strong government incentive program (Ecobonus) that has successfully stimulated demand. The Italian market has a high potential for electric two-wheelers and small city cars, aligning with its urban topography. •Spain is emerging as a powerhouse, bolstered by massive investments in battery gigafactories (e.g., Volkswagen's plant in Sagunto). The "MOVES III" incentive scheme is one of Europe's most generous, driving strong growth. Spain's geography—with a dense, populated coastline and a sparser interior—creates a distinct demand pattern.

•Portugal is a standout performer, boasting one of Europe's highest rates of public charger per EV. Early investment and strong government commitment have created a mature ecosystem for its size. High renewable energy penetration also makes EV charging inherently greener, a key marketing point. •Greece is leveraging post-pandemic recovery funds to make a dramatic push. With one of the oldest vehicle fleets in Europe, the renewal incentive is powerful. The unique combination of dense islands and mountainous terrain presents a unique infrastructure challenge.

These nations are critical to understand despite their small size. Their confined geography makes "range anxiety" a non-issue for local drivers, but they face extreme challenges: •Grid Constraints: Isolated, non-interconnected grids have limited capacity, making uncontrolled charging a direct threat to grid stability. •Tourism Amplification: Vehicle rental fleets are rapidly electrifying, creating intense, seasonal demand for fast and reliable public charging. •Salt Corrosion: The coastal environment is exceptionally corrosive, demanding hardware with superior protective measures. Unifying Insight: Across all tiers, the transition is accelerating. However, the next wave of adoption will be driven by the commercial sector (rental cars, last-mile delivery, logistics) and the mainstream consumer, both of whom are far less tolerant of unreliable or inconvenient charging experiences than early adopters.

Demand analysis must extend beyond population density to incorporate the region's economic and geographic DNA: tourism, coastal living, and specific commercial flows.

The Mediterranean is the world's top tourist destination. This creates a non-negotiable demand for a robust, reliable, and user-friendly public charging network along: •Coastal Corridors: The entire Mediterranean coastline, from the Costa del Sol to the French Riviera and the Greek islands, requires a dense network of DC fast chargers (50-150kW) to serve rental cars and touring vehicles. •Tourist Hotspots: Chargers at hotels, resorts, archeological sites, and restaurants are shifting from a luxury amenity to a standard utility. For these destinations, charger aesthetics, ease of use, and reliability directly impact customer satisfaction. •Demand Volatility: Charging infrastructure must be built to handle extreme seasonal peaks without failure, requiring hardware with robust thermal management and a design philosophy centered on maximum uptime.

A significant portion of the population in Spain, Italy, and Greece lives in dense urban areas or historic city centers with limited off-street parking. This creates a massive demand for public on-street AC charging (7-22kW). The challenge is not technological but logistical and political: navigating municipal permissions, integrating with street furniture, and ensuring vandal-resistant designs. Solutions must be compact, aesthetically neutral, and incredibly durable.

The Mediterranean ports of Valencia, Piraeus, and Genoa are critical EU logistics hubs. The electrification of port machinery, drayage trucks, and last-mile delivery vans is commencing. This creates a clear and urgent demand for: •Depot Charging: Overnight AC charging for vans and buses, requiring smart load management to avoid peak demand charges. •Strategic High-Power Charging (HPC) Hubs: Locations for heavy-duty truck charging along the AP-7 in Spain and the A1 in Italy must be planned now. For fleet operators, Total Cost of Ownership (TCO) and operational uptime are the sole decision-making metrics. A charger that saves €5,000 upfront but causes €20,000 in downtime losses is a poor investment.

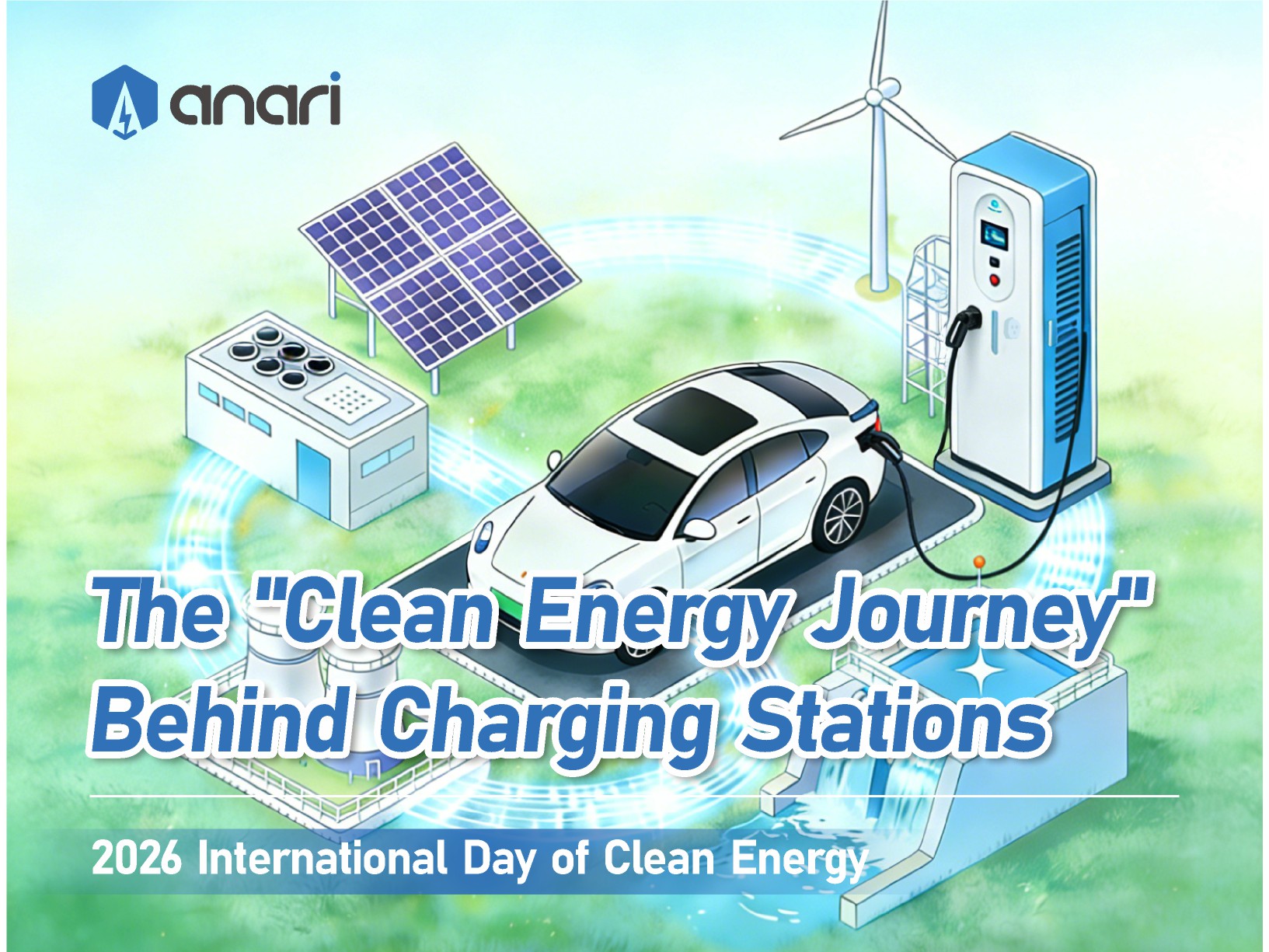

Mediterranean Region is increasingly prone to heatwaves and grid stress. The simultaneous demand from air conditioning and EV charging poses a real risk. Therefore, charging solutions must be part of the grid stability solution, not the problem. Features like smart power management, low harmonic distortion, and readiness for V1G/V2G applications are transitioning from premium features to regional necessities. Products like the Anari EV Pales DC Series, engineered with grid-friendly operation and resilient performance as core tenets, are inherently suited to these conditions.

The current infrastructure map reveals both progress and profound strategic gaps. •The North-South Divide: A clear density gradient exists, with northern Italy, Catalonia, and southern France having relatively mature networks, while southern Italy, Greece, and Portugal's interior are significantly underserved. These risks create a two-tier mobility system within the region itself. •Power Misalignment: Many early installations were lower-power AC units. There is now a scramble to install DC fast chargers, but often without a strategic corridor-based approach, leading to a patchwork of isolated points rather than a reliable network. •The Reliability Deficit: A critical, often unspoken issue is the poor reliability and maintenance of existing chargers, particularly in tourist areas outside the core markets. A charger shown on a map that is out of service erodes consumer trust more than having no charger at all. •Fragmented User Experience: The proliferation of local CPOs, especially in Italy and Spain, creates a frustrating user experience for cross-border and domestic travel, requiring a wallet full of RFID cards or numerous apps.

A visionary yet pragmatic decade-long plan is required, moving from foundational coverage to an intelligent, integrated energy system.

•Focus: Ensure every major highway and transnational corridor (e.g., Via Mediterranea, AP-7, A1) has 100% reliable DC fast-charging coverage at intervals of no more than 100 km. Prioritize sites with amenities (e.g., service stations, cafes). •Action in Cities: Municipalities must drive the dense deployment of on-street AC charging, standardizing permitting processes. Hardware must be uniform, vandal-proof, and interoperable. •Technology Emphasis: Deploy proven, rugged DC chargers (50-150kW) with high IP ratings for dust and water resistance and corrosion-resistant coatings. The focus is on achieving 99%+ uptime. The Anari EV Pales DC Series, with its robust environmental protection (IP54 standard and above) and advanced thermal management, is engineered for this exact purpose—providing dependable service in harsh coastal and high-temperature environments.

•Focus: Upgrade 50% of high-traffic highway sites to HPC (150-350kW) to accommodate next-generation EVs and longer-range electric trucks. Achieve full interoperability between all major CPOs in the region. •Action: Begin targeted deployment of HPC hubs near major logistics centers and airports. Integrate real-time data and dynamic load management across the network to optimize for renewable energy sources (solar, wind). •Technology Emphasis: Scale software platforms and introduce modular chargers that can be upgraded on-site. Pilot solar canopies and battery storage at high-demand sites to alleviate grid pressure.

•Focus: Achieve charging ubiquity in urban areas. Make bi-directional charging (V2G) a standard feature for new AC and DC installations, turning the regional EV fleet into a distributed energy resource for grid balancing. •Action: Full rollout of V2G services, allowing EVs to power homes during outages or sell energy back to the grid during peaks. Deep penetration of renewable-powered microgrids at remote and island locations. •Technology Emphasis: Focus on advanced cybersecurity, AI-driven energy trading platforms, and ultra-high-power Megawatt Charging Systems (MCS) for maritime and heavy freight.

The Mediterranean EV charging market is at an inflection point. The opportunities are vast, but the pitfalls for the unprepared are equally significant. The region's specific conditions—its climate, its economic reliance on tourism, and its varying grid stability—demand a specialized approach. The strategic imperatives for stakeholders are clear: •Prioritize Operational Resilience: In a tourism-dependent economy, charger reliability is not a feature—it is the product. Hardware must be engineered for extreme weather, high utilization, and corrosive environments. •Embrace a Phased, Corridor-First Strategy: Building consumer confidence requires creating a seamless long-distance travel experience first, which then stimulates further local EV adoption and urban charging demand. •Design for the Grid, Not Against It: The winning solutions will be those that incorporate smart charging and storage from the outset, positioning CPOs as partners to utilities, not adversaries. •Recognize the Bifurcated Market: Strategy must differentiate between the high-power, high-competition corridors of France and Spain, and the value-driven, resilience-focused needs of Greece, Southern Italy, and the islands. Strategic Implication for Anari Energy: Our core philosophy—"Engineered for Reliability and the Future"—is not a generic slogan but a direct response to the Mediterranean market's fundamental needs. Our product roadmap, from the rugged and cost-effective Pales DC Series for emerging corridors and tourist towns to our development of future HPC and V2G-ready systems, is deliberately aligned with the phased development of this region. We are committed to providing our partners—CPOs, distributors, and installers—with the robust, grid-adaptive, and economically intelligent infrastructure required to build not just a charging network, but a lasting and profitable business in the heart of the new electric Mediterranean.