The Philippine electric vehicle (EV) market is at a critical inflection point. Driven by progressive policy reforms, ambitious national targets, and a burgeoning consumer and commercial interest, the ecosystem is poised for rapid growth. However, the central nervous system of this transition—the charging infrastructure—remains significantly underdeveloped. This report analyzes the Philippine EV charging pile market, identifying a significant supply-demand gap that presents a substantial opportunity for strategic investment and innovation. We project that the current public charging station count of 962 must expand at a Compound Annual Growth Rate (CAGR) of over 65% to meet the government's target of 7,300 stations by 2028. Success in this market will not be determined by hardware sales alone, but by the ability to navigate a complex landscape of public-private partnerships, grid integration challenges, and evolving user needs. For stakeholders—from installers and operators to fleet managers—the coming 36 months will be decisive in establishing market leadership. This report concludes that partnerships with technologically agile and globally experienced charging solutions providers, such as Anari Energy, will be a critical differentiator in building a profitable, scalable, and resilient charging network across the Philippine archipelago.

The Philippine government has laid a foundational policy framework that directly accelerates demand for charging infrastructure. The recent Department of Energy (DoE) reclassification of EVs into six distinct categories is more than a bureaucratic exercise; it is a demand signal. By explicitly including Plug-in Hybrid Electric Vehicles (PHEVs) and Range Extender EVs, the policy validates a broader spectrum of electrified transport, appealing to the estimated 70% of potential adopters concerned about range anxiety. This will inevitably inflate the addressable market for charging points, as PHEVs, while capable of running on fuel, still require regular plug-in charging for optimal economic and environmental benefits.

Concurrently, the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act offers significant fiscal incentives for capital expenditure in strategic sectors, including EV infrastructure. When combined with the extended zero-tariff policy on EV imports through 2028, which is expected to boost sales of affordable models, the result is a clear, policy-driven growth trajectory for the entire EV value chain. For charging infrastructure players, this means the market is being primed for expansion from both the supply (vehicle availability) and demand (consumer incentives) sides.

The core challenge and opportunity lie in the vast infrastructure deficit. With only 962 public charging stations as of Spring 2025—80% of which are concentrated in Metro Manila—the Philippines lags behind regional peers like Thailand, which boasts over 5,000 stations. This equates to approximately one charger per 110,000 people, a ratio that is unsustainable for mass adoption.

The gap is not merely quantitative but also qualitative:

To address these gaps, a multi-pronged deployment strategy is essential. Stakeholders should prioritize the following segments:

The most critical step, as identified by industry experts, is the implementation of mandatory, performance-based PPPs. The government’s role should be to de-risk private investment through mechanisms like:

The government’s Public Utility Vehicle Modernization Program (PUVMP) and the growth of e-logistics represent a highly predictable and concentrated demand source. E-jeepneys and e-tricycles operate on fixed routes with centralized depots, making them ideal for scheduled charging.

To truly conquer range anxiety and unlock the four-wheeler market, a strategic rollout along major highways like the Luzon Spine Expressway Network and key connectors in Visayas and Mindanao is non-negotiable. This requires a focus on DC Fast Chargers spaced at 50-100 km intervals. The success of Vietnam in doubling its charger count through targeted highway subsidies provides a compelling regional model.

The high CapEx of charging infrastructure, particularly DC fast chargers, is a key barrier. Innovative business models are emerging to improve ROI:

Supporting a projected 100,000-strong EV fleet by 2030 requires proactive grid management. The 10-15% potential peak load strain is a material risk.

Anari Energy Insight: Our entire product ecosystem is designed for a smart grid future. The Anari Synergy Software Platform enables smart charging, load management, and is V2G-ready. For installers and operators, this future-proofs their investment, allowing them to participate in advanced energy markets as they emerge in the Philippines.

The current market is fragmented, with a mix of utility-led initiatives (Meralco), property developer projects (SM Supermalls), and early-mover specialized operators. The extended zero-tariff policy solidifies the dominance of Chinese EV brands like BYD, which often promote their own or affiliated charging standards.

This presents both a challenge and a strategic imperative for other players. To compete effectively, new entrants and expanding operators must:

The Philippine EV charging market is on the cusp of a transformative growth phase. The convergence of supportive policy, clear infrastructure targets, and rising EV adoption creates a window of opportunity that will not remain open indefinitely. The race will be won by those who act with strategic intent over the next 24-36 months.

For stakeholders in the Philippine market, we recommend:

The journey to a fully electrified transport system in the Philippines is a marathon, not a sprint. It requires partners with not just advanced hardware, but a deep understanding of the integrated challenges of infrastructure, grid management, and commercial viability. As a world-leading new energy company, Anari Energy is committed to providing the technology, expertise, and partnership to help Philippine businesses navigate this transition and power a cleaner, more efficient future.

Anari Energy Insight: Our Anari A-Series DC Fast Chargers are engineered for high-throughput environments like depots and logistics hubs. With dynamic power sharing and advanced thermal management, they ensure maximum uptime even in the Philippines' tropical climate, directly addressing the operational criticality for commercial fleet operators.

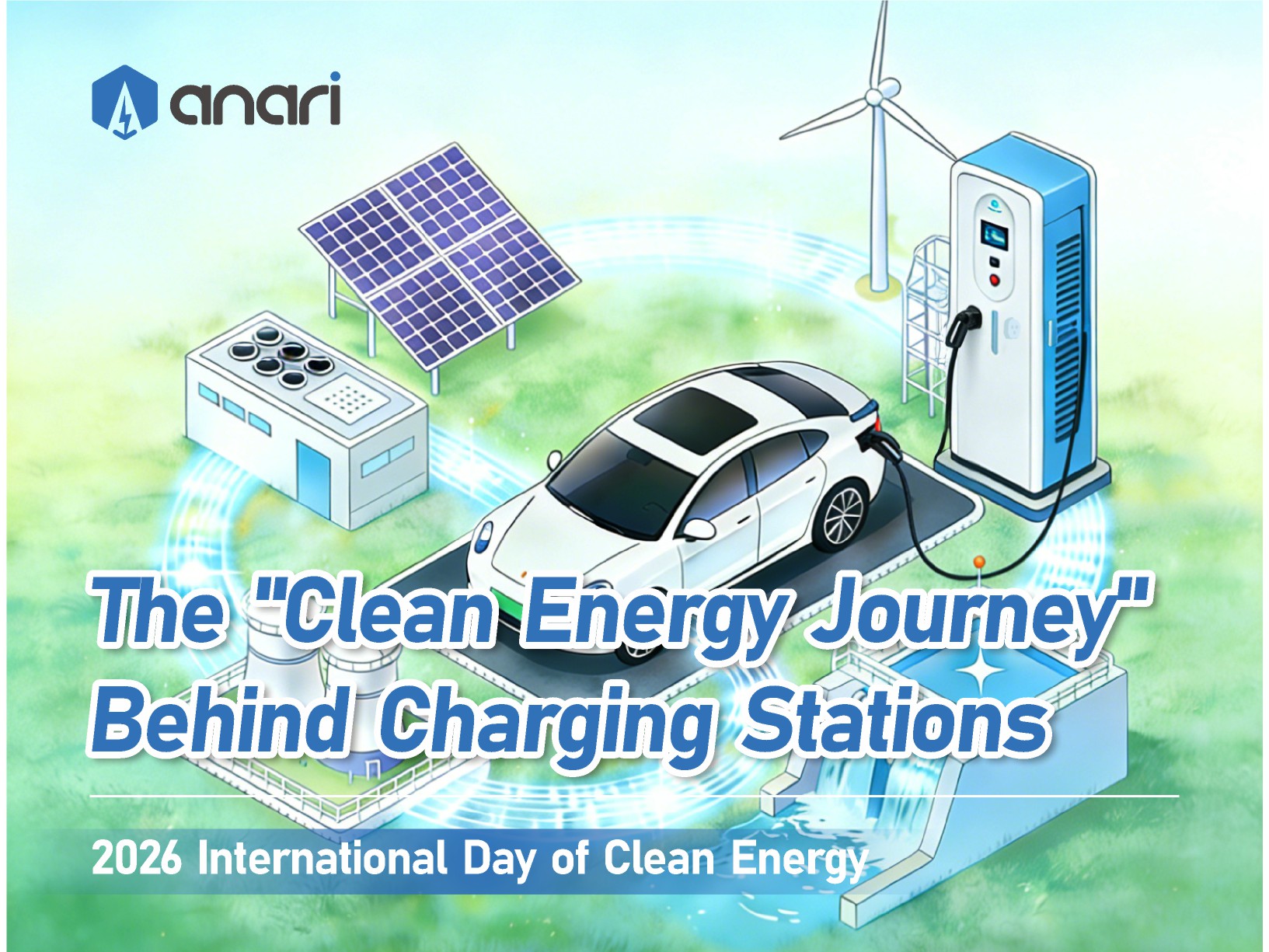

Anari (www.anariev.com), a leading Chinese manufacturer of EV charging systems, delivers a comprehensive portfolio of AC and DC charging solutions designed for both public fast-charging networks and destination slow-charging applications. Renowned for their reliability, superior user experience, and exceptional return on investment, Anari's products have become trusted choices worldwide. Building on its core charging business, Anari is actively advancing its global expansion in photovoltaic and energy storage technologies. This strategic integration enables the company to offer a fully synergistic clean energy ecosystem—PV generation, storage, and intelligent charging—that supports a sustainable future. Through these efforts, Anari is positioned at the forefront of the global energy transition, empowering communities and industries with innovative, grid-independent energy solutions across international markets.